A vehicle mileage log is a spreadsheet document which is used to track the mileage of the vehicle. There are many purposes for keeping the vehicle mileage log. Usually, mileage log is used by businesses when they want to keep track of mileage of the business vehicle.

In businesses, recording mileage is helpful in getting the amount of tax to be paid, reimbursement and a lot more. It is the easiest way to calculate the mileage of your personal as well as business vehicle.

Car mileage is the first credential which acts as the deciding factor of taking any new car. Free mileage log template gives every detail of car graduated in a scale that can show which number acts as the best mileage. To download PSD mileage log template you can have a car with its mileage shown on the log or graduated on the car itself. Car mileage is the first credential which acts as the deciding factor of taking any new car. Free mileage log template gives every detail of car graduated in a scale that can show which number acts as the best mileage. To download PSD mileage log template you can have a car with its mileage shown on the log or graduated on the car itself.

How to make a good mileage log?

A good mileage log can be made easily by adding the necessary details in it that are needed to effectively calculate the mileage. A good mileage log should include the purpose of calculating the mileage as well as the total distance covered. It should include the place traveled by the vehicle. Making a good mileage log requires some serious efforts to be put.

- The log will need to be shown again to a Driver Testing Examiner showing that at least 50 hours (including 10 hours of nighttime driving) were completed before the teen is allowed to take the Driving Skills Test. The log that follows and the free mobile app, RoadReady®, are the preferred formats. Other driving log formats will be accepted.

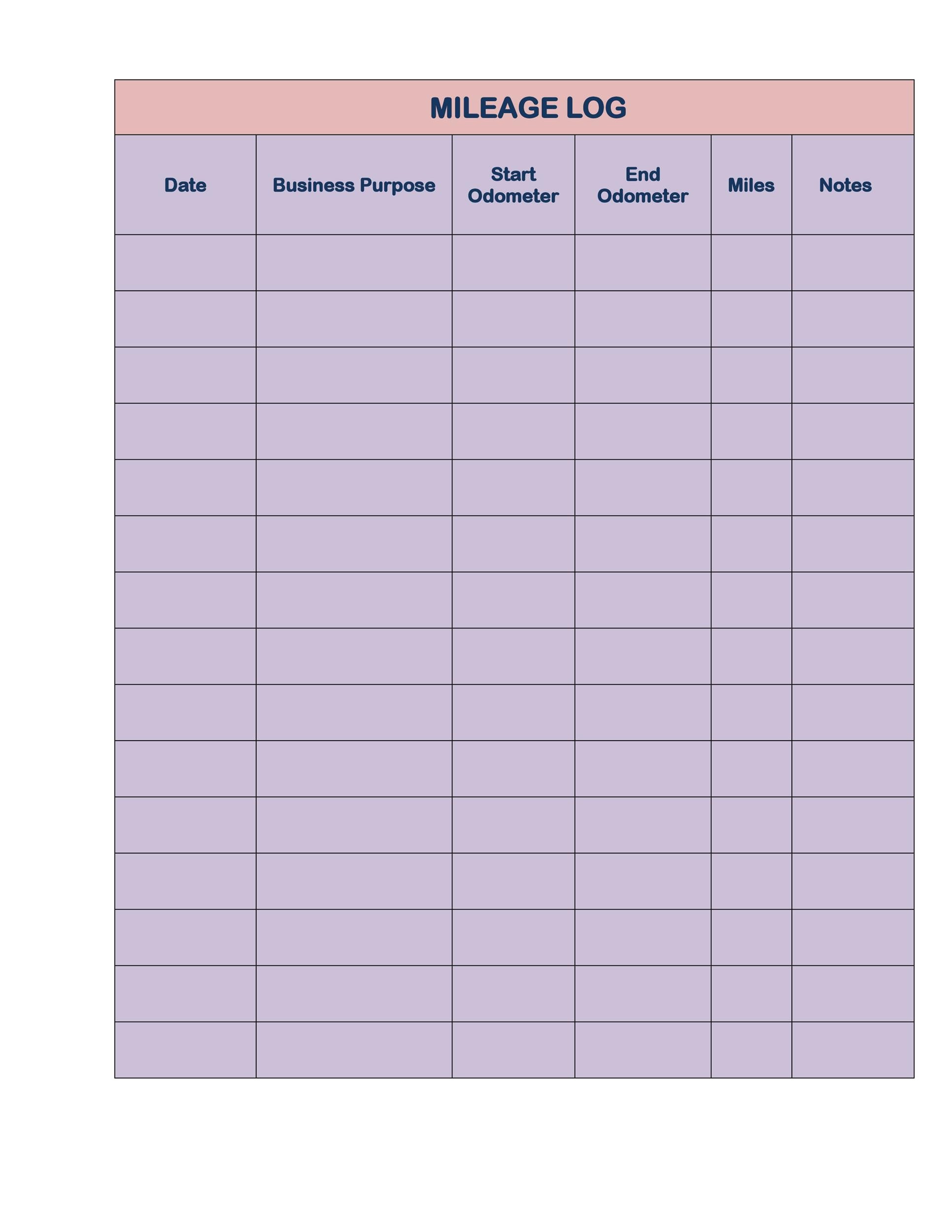

- Mileage Log 1. This log allows you to keep track of the mileage a driver puts on a specific vehicle. It records miles driven for business use and personal use. Click here to open as a PDF Click here to open as a PNG.

The user should keep an eye on the odometer and should note down the date on which the odometer reading is recorded. With this, the number of days covered by mileage log can be seen

Download

Mileage log for the personal record:

It should be noticed that the mileage log is not always required to be used for business purpose. It can also be used to record the personal mileage data. Many people want to keep track of the mileage of their vehicle in order to know how efficiently their vehicle can run over a large distance.

Some people also use personal mileage to know when their vehicle needs servicing. Anyone who is interested in keeping track of the mileage should always keep a receipt or a scrapbook where the mileage can be noted before the odometer is set to its initial value.

Mileage log for office employees

A mileage log is also used by office employees while preparing expense report. The objective of the employees behind using this log is to let the company know the total expenses incurred during their travel so that they can apply for reimbursement.

Some employees use mileage log as a part of expense report while some prepare a separate log when the mileage log is a primary thing to be explained to an employee while asking for reimbursement. The employees should use this log carefully because the company can conduct inquiries to see if they have calculated the mileage correctly or not.

Mileage log for reimbursement

One of the major purposes of preparing the mileage log is reimbursement. Reimbursement is very important in any organization that requires some documents and proofs of expenses to be represented before the employer.

The employee is required to record the mileage when he uses the vehicle for doing some business work. The starting and ending value of the mileage, the details of the place visited and the purpose of using the vehicle should be explained in the mileage log so that the reimbursement of all the expenses can be done.

The reimbursement of all the expenses depends on the figures described in the mileage log. All the calculations should be done with complete accuracy by the log. It should be kept in mind that the employee does not have any right to deduct the travel expenses. He is required to track the mileage only and the rest will be done by the company.

Mileage log for taxes

A mileage log is widely being used for calculation of tax. It has become one of the most important and beneficial features of mileage log. Those people who use their vehicle for business purpose can get a relief by deducting some vehicle-related expenses from their taxable income.

Download

Download

The deductions from the taxable income can be made only when you are traveling from your company to another company. It does not include the mileage of the vehicle covered while moving from your house to office. The vehicle owner can deduct the costs of the vehicle from the income and thus reduces the amount of tax to be paid.

Blank mileage logs

Mileage Log Form Driver For Mac 2017

Mileage Log Form Driver For Mac 2017

Different blank mileage logs are available on the internet to be used by people. These logs are blank and require the information to be input so that calculations can be done. It is very beneficial to use blank mileage log as the user can add and remove the details from it according to his needs.

Free Mileage Log

Mileage log as mileage calculator

A mileage log is not only a sheet where the mileage is recorded. It also contains a built-in calculator that performs the calculations based on the information provided. The mileage calculator is one of the most effective tools that enable the user get the accurate results without having to calculate everything related to mileage.

This calculator enables everyone to use this log no matter they have the expertise or not. This calculator performs the calculations rapidly with complete accuracy. There is very less chance of getting wrong calculations. It saves the time of the user who wants everything related to the calculation of mileage to be done in no time.

Mileage log template for MS Excel

To help yourself in accelerating the process of mileage recording, mileage log template is the best tool to use. The mileage tracker is usually prepared in MS Excel file. You can start entering the value from the start of the month and print the template easily at the end of the month. At the end of the month, the template will automatically calculate everything such as total mileage.

The Excel spreadsheet contains many columns where you can record different details which are necessary to track vehicle mileage.

The use of the template is very beneficial in many ways. The customizable template for mileage log has built-in formulas that calculate every detail about the mileage. The complex calculations related to tax deductions and reimbursement can be done easily through the use of a template. Moreover, this template is easy to customize. The user can add or omit the details from the template according to his needs.

Download

Download

Mileage Log Form Driver For Mac Pro

Download